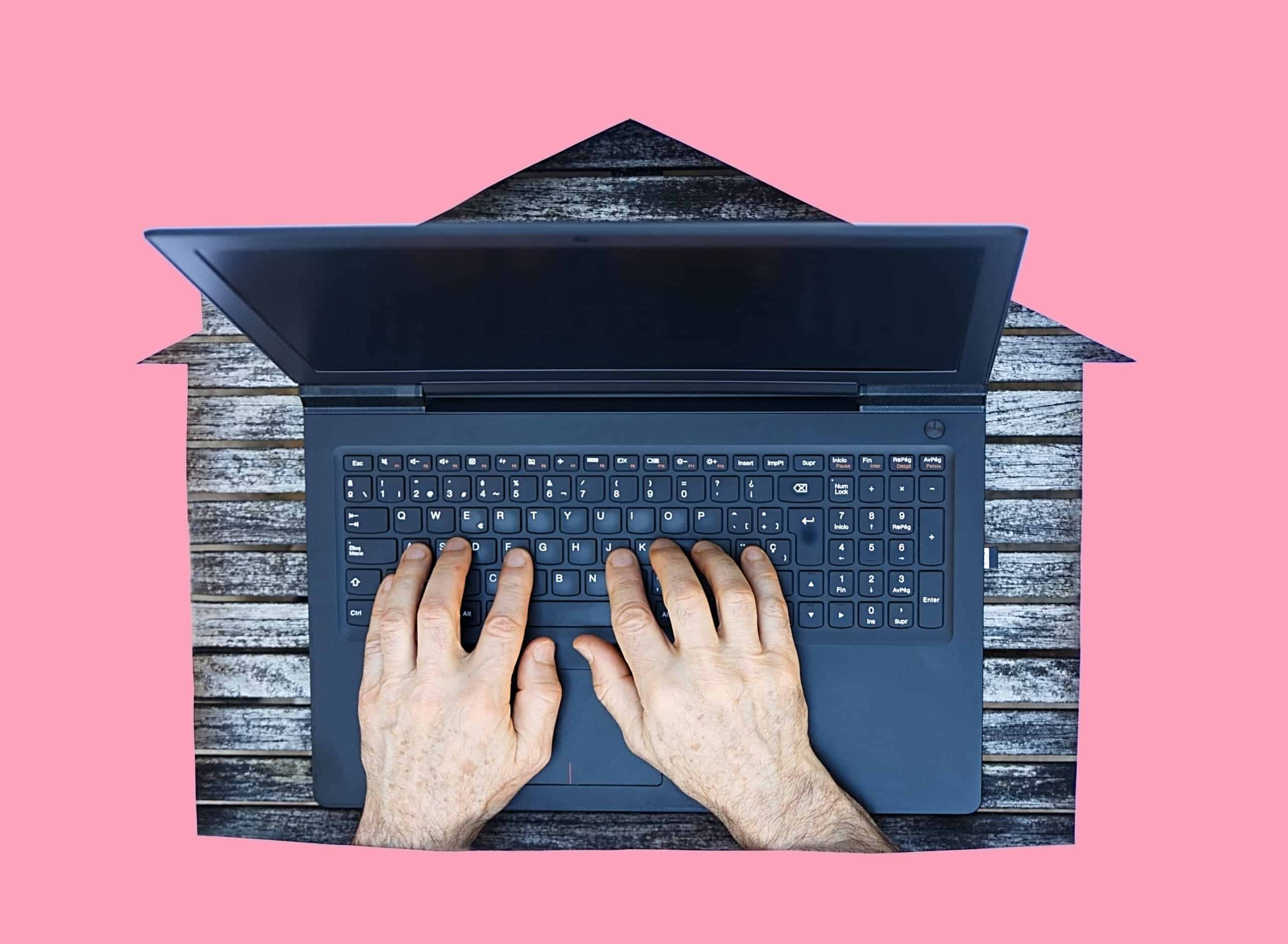

Tax at Source on Employees with Employment in Geneva and Working from Home in France

EU (& EEA) & Swiss employees of Geneva entities who live in France can, since 1 July 2023, spend up to 40% of their work time from home (the framework agreement can be reviewed here). If they exceed this limit there will be a need to register for not only French social security contributions for […]